virginia estate tax exemption

Though there isnt an estate tax in Virginia you might have to pay the federal estate tax. Pursuant to subdivision a of section 6-a of article x of the constitution of virginia and for tax years beginning on or after january 1 2011 the general assembly hereby exempts from taxation the real property including the joint real property of husband and wife of any veteran who has been rated by the us.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

The exemption applies to real property which includes your home or condominium and personal property used as a residence so your mobile home would also be covered.

. The federal estate tax exemption is 5450000 for decedents dying in 2016. Senior citizens and totally disabled persons have the right to apply for an exemption deferral or reduction of property taxes in Virginia. Code 581-900 through 581-938 do not currently impose a tax no remainder interests are subject to the Virginia estate tax.

Therefore the remainder interest in the marital trust was not subject to the Virginia estate tax and is not exempt from the postponed inheritance tax. Each filer is allowed one personal exemption. Applicants qualify for 100 relief if their gross income is less than 52000.

Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020. The federal estate tax exemption is 1170 million in 2021 and goes up to 1206 million in 2022. The tax is assessed at the rate of 10 cents per 100 on estates valued at more than 15000 including the first 15000 of assets.

When using the Spouse Tax Adjustment each spouse must claim his or her own personal exemption. If you are a surviving spouse of a First Responder who has been killed in the Line of Duty your principal residence may be eligible for an exemption of your real estate taxes on your home and up to one acre in Virginia. Property Exempt by State Law.

Pursuant to subdivision a of section 6-a of article x of the constitution of virginia and for tax years beginning on or after january 1 2011 the general assembly hereby exempts from taxation the real property including the joint real property of married individuals of any veteran who has been rated by the us. An exemption may be claimed for each dependent claimed on your. There is no inheritance tax in West Virginia.

Localities may also impose a local probate tax. Department of Veteran Affairs determined have a 100 service-connected permanent and total disability are eligible for a sales and use tax exemption on the purchase of a vehicle owned and used primarily by or for the qualifying veteran. The commonwealth of virginia exempts from taxation the real property including the joint real property of husband and wife of any veteran who has been rated by the u.

The exemption is portable meaning that one spouse can pass their exemption to the other. The federal estate tax exemption is 1170 million for 2021 and will increase to 1206 million for deaths in 2022. Department of veterans affairs or its successor agency pursuant to federal law to have a 100 service connected permanent and total disability and who occupies the real.

Pursuant to subsection 6 a 6 of article x of the constitution of virginia on and after january 1 2003 any county city or town may by designation or classification exempt from real or personal property taxes or both by ordinance adopted by the local governing body the real or personal property or both owned by a nonprofit. A tax in an amount computed as provided in this section is imposed upon the transfer of real property and tangible personal property having an actual situs in the Commonwealth of Virginia and upon intangible personal property physically present within the Commonwealth of every person who at the time of death was not a resident of the United States. For example the tax on an estate valued at 15500 is 1550.

The relief depends on the total gross income ie. SB 686 expands energy freedom for consumers and creates an additional incentive to do business in the Commonwealth. Up to 25 cash back Under the Virginia exemption system homeowners can exempt up to 25000 of equity in a home or other property covered by the homestead exemption.

West Virginia wont tax your estate but the federal government may if your estate has sufficient assets. Federal Estate Tax. Property owned directly or indirectly by the Commonwealth or any political subdivision thereof.

There are certain requirements they must meet to qualify for the tax relief programs. For married couples each spouse is entitled to an exemption. Virginia allows an exemption of 930 for each of the following.

In 2019 Petersburg brought a claim against the Emmanuel Worship Center for nearly four years worth of past-due real estate taxes of about 30000. For Virginians who died prior to mid-2007 Virginias state estate taxes began at about 8 percent on estates over 2 million and rose to about 16 percent for estates over 10 million. Be 65 or older Be totally or permanently disabled Own and reside in the property being taxed.

You are not eligible for this tax exemption if you have remarried. It also asked the court for a decree of sale to. Virginia Property Tax relief for Seniors and DisabledCitizens who are over 65 permanently disabled and meet the income and asset eligibility criteria qualify for this type of exemption.

There is a federal estate tax and many states levy their own estate taxes. While other local jurisdictions have an exemption that is lower Virginia does not. A common exemption is purchase for resale where you buy something with the intent of selling it to someone else.

Veterans of the United States Armed Forces or the Virginia National Guard who the US. Updated July 27 2017. The exemption is portable for spouses meaning that with the right legal steps a couple can protect 2406 million after both spouses have died.

The estate tax exemption for New York increases to 611 million while that for Washington state remains unchanged at nearly 220 million. Virginia law allows businesses to purchase things without paying sales tax if they or their purchase meet certain criteria. Exemptions Generally Read all 581-3600 Definitions 581-3601 Property becomes taxable immediately upon sale by tax-exempt owner 581-3602 Exemptions not applicable to associations etc paying death etc benefits 581-3603 Exemptions not applicable when building is source of revenue 581-3604 Tax exemption information.

By Kelsey Misbrener April 12 2022 Virginia Gov. Glenn Youngkin signed a bill into law today that creates a property tax exemption for residential and mixed-use solar energy systems up to 25 kilowatts. Pursuant to the authority granted in Article X Section 6 a 6 of the Constitution of Virginia to exempt property from taxation by classification the following classes of real and personal property shall be exempt from taxation.

However that does not mean that individuals or residents of Virginia should not be concerned with the estate tax.

How To Avoid Estate Taxes With A Trust

Assessing The Impact Of State Estate Taxes Revised 12 19 06

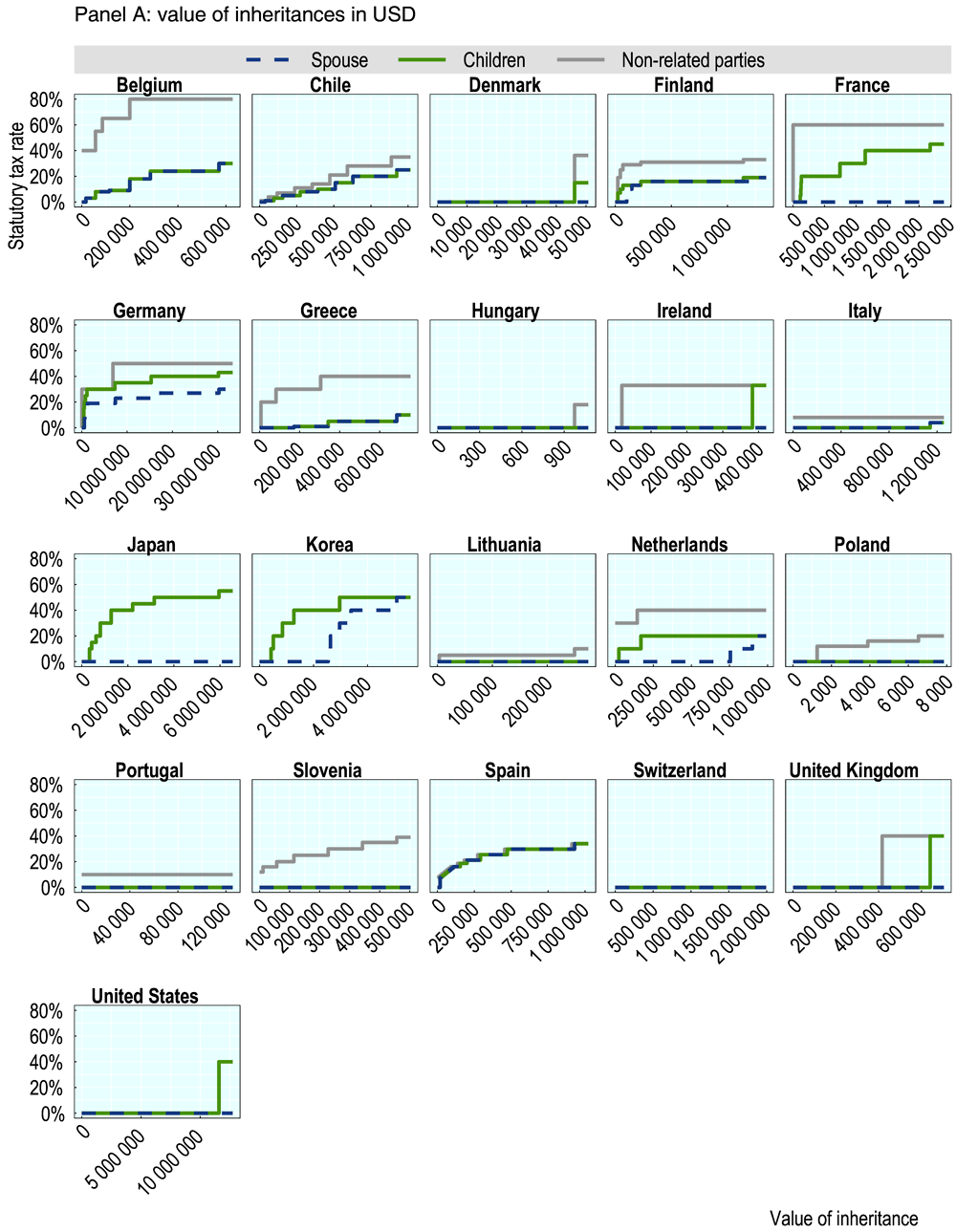

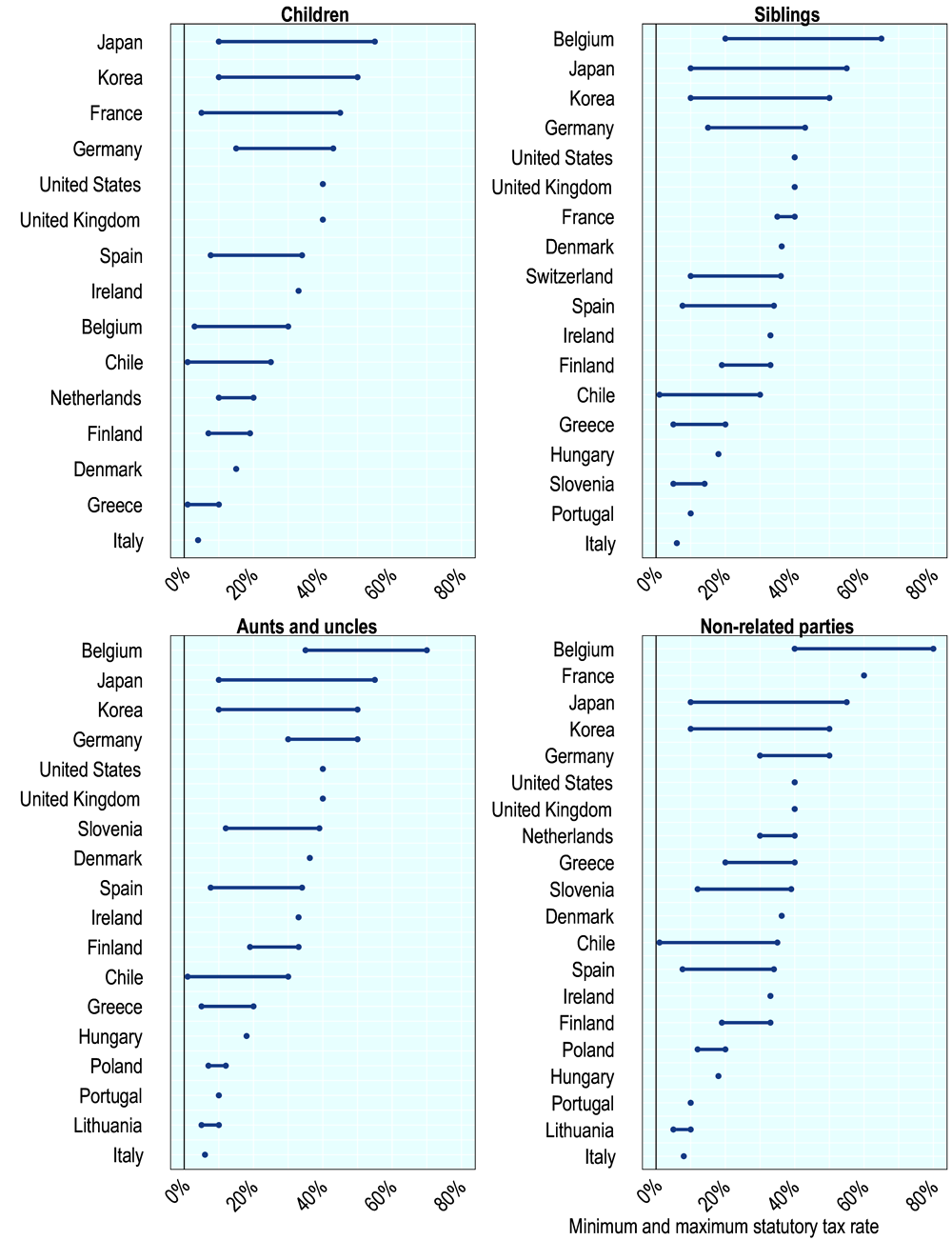

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

How Your Estate Is Taxed Or Not

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Zarazua Law San Antonio Bankruptcy Attorney Mortgage Payment Home Equity Attorneys

Virginia Estate Tax Everything You Need To Know Smartasset

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Recent Changes To Estate Tax Law What S New For 2019

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

Estate Tax Exemption 2021 Amount Goes Up Union Bank

Virginia Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die